This table does not include all companies or all offered items. Interest does not back or suggest any companies. Editorial Policy Disclosure Interest. com complies with rigid editorial policies that keep our authors and editors independent and honest. We count on evidence-based editorial standards, regularly fact-check our content for precision, and keep our editorial staff entirely siloed from our advertisers. If the rate were to go up 1 basis point, it would increase to 3. 26%. If it were to increase 50 basis points, it would increase to 3. 75%. A 100-basis point boost would lead to a 4. 25% rate. If a loan rate is 5% and increases 20 basis points, that is the equivalent of raising the rate of interest by 0.

2%. If rate of interest are at 4. 75% and drop to 4. 6%, that is a 15-basis point (0. 15%) decline. Although a basis point seems little, even a modest modification can make a big distinction in the overall interest you pay over the long term. Here is a chart showing how total payments on a $200,000 loan modification, based on a 30-year fixed home mortgage of 3.

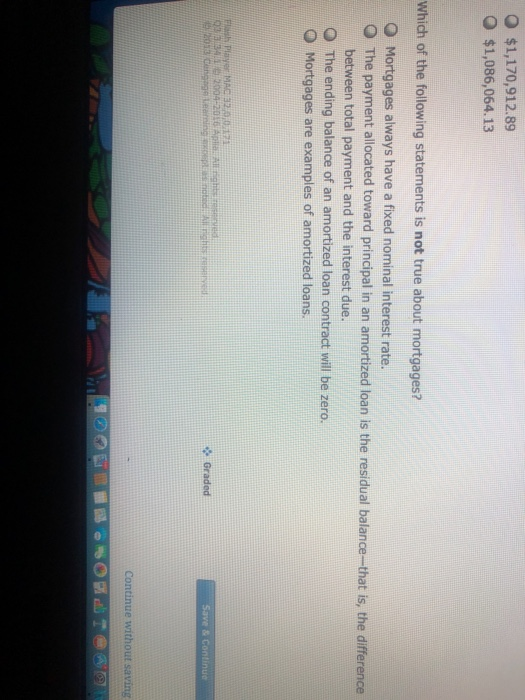

75%-- $926. 23 $333,444 $133,444 3. 85% 10 points $937. 62 $337,541 $137,541 3. 95% 20 points $949. 07 $341,668 $141,668 4. 25% 50 points $983. 88 $354,197 $154,197 * Rates are for example just. Your rate will depend on present home mortgage rates plus your timeshare sales credit rating. Do not puzzle discount rate points (frequently just called points) with basis points.

.jpg)

For example, a point on a $200,000 loan would equate to $2,000. When you pay discount rate points, you're essentially prepaying some of the interest on a loan. The more points you pay at closing, the lower the rate of interest will be over the life of the loan. This can help make monthly payments more budget-friendly and save money in interest over the long term.

Portfolio managers and financiers utilize basis points to show the portion change in interest rates or financial ratios in U.S. Treasury bonds, shared funds, exchange-traded stocks and real estate-based financial investments. Professionals utilize mathematical terms to describe basis points however even if you're not a monetary expert or lender, you can understand them, too.

Some Of What Are Interest Rates For Mortgages

One basis point equates to 0. 01%, or 0. 0001. One hundred basis points equals 1%. How does this translate to home mortgages? Let's state you have an adjustable rate home loan (ARM). Your rates of interest is 3. 50%, then the rates of interest changes to 3. 75% at a later date. This suggests your rate of interest increased by 25 basis points.

You'll hear the term "basis points" typically used in connection with home mortgages (what does ltv stand for in mortgages). One basis point is 1/100 of 1 percent. While definitely not a large portion quantity, basis points can be very crucial in mortgage https://b3.zcubes.com/v.aspx?mid=7336198&title=how-much-is-mortgage-tax-in-nyc-for-mortgages-over-500000oo-can-be-fun-for-everyone scenarios. Due to the fact that of the size of mortgage, basis points although little numbers - what is the current variable rate for mortgages. When you hear or check out about an increase/decrease of 25 basis points, you must know this means one-quarter of 1 percent.

01 percent in interest. which credit report is used for mortgages. Especially crucial to large-volume home mortgage loan providers, basis points-- even just a couple of-- can imply the distinction in between revenue and loss. Financially speaking, mortgage basis points are more essential to lending institutions than to borrowers. However, this effect on lending institutions can likewise impact your mortgage interest rate.

25 or 0. 375 percent their used mortgage rate to debtors potentially you. Basis points are popular with larger investments such as bonds and mortgages since. Unless you work in the world of finance, you may not be aware of the popularity of basis points (how to qualify for two mortgages). From a home mortgage point of view, little increases in basis points can mean larger modifications in the interest rate you may pay.

When you compare mortgage rates and terms, you will ultimately come across basis points. For instance, you talk with a loan officer, telling him/her that you desire to lock-- how to get out of a timeshare legally ensure your rate at closing-- your rate for 60 days. The loan officer then encourages you that the lending institution charges 50 basis points to lock your rate for that duration.

The Main Principles Of Who Does Usaa Sell Their Mortgages To

Home mortgage rates tend to "lag" be a bit behind other market interest rates. Understanding basis points might help you, to a degree,. If you are almost ready to make a mortgage application, knowledge of basis points may help you save some cash. For example, you notice bond yields and prices increased by 20 basis points on Monday.